By Mark Maremont – July 2, 2015

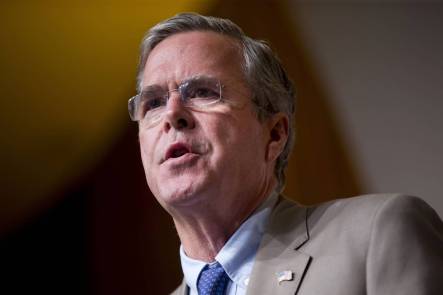

In the tax returns he released Tuesday, GOP presidential candidate Jeb Bush reported large deductions for payments to “pension and profit-sharing plans.” The payments averaged $350,000 a year for the past five years, far more than most people could contribute to an individual retirement account or 401(k) plan.

Other documents Mr. Bush has filed show that he used a little-known but perfectly legal tax strategy to establish a pension plan for two people working for his consulting firm, Jeb Bush & Associates LLC. Attorneys who work with such plans say one of them was almost certainly Mr. Bush himself and the other was likely his son, Jeb Bush Jr.

The strategy has allowed Mr. Bush to defer paying hundreds of thousands of dollars in income taxes since he established the plan in 2007 and to rapidly build up a large retirement-plan balance, the attorneys say.

In a blog posting, Bill Parish, a Portland, Ore., investment adviser, called Mr. Bush’s pension plan “aggressive,” in part because the defined-benefit plan assumes a retirement age of 62. That allowed Mr. Bush, who turned 62 in February, to contribute more money more quickly than if the plan had assumed retirement at 65. Mr. Bush’s election as president wouldn’t have any impact on the retirement plans.

Note: This story was based upon original research by Parish & Company.