See Latest Post on Nov 27 For Significant Updates After Release of the “Paradise Papers” – Access Via Blog Search for Trump Patron

President Trump’s most significant backer, Robert Mercer (CEO of the giant hedge fund Renaissance Technologies), is Deutsche Bank’s largest customer. Deutsche Bank is indeed also President Trump’s and Jared Kushner’s largest lender. One phone call from Mercer and either should be able to refinance or gain a new loan, as both did in 2016.

Trump and Kushner are small potatoes compared to Mercer’s Renaissance hedge fund. And without Robert Mercer and his daughter Rebekah playing key roles, perhaps Donald Trump would never have ascended to the Presidency. For this reason Renaissance’s activities with Deutsche Bank will clearly be drawn into Robert Mueller’s inquiry given Deutsche Bank’s strong ties to Russia’s largest banks and Mercer.

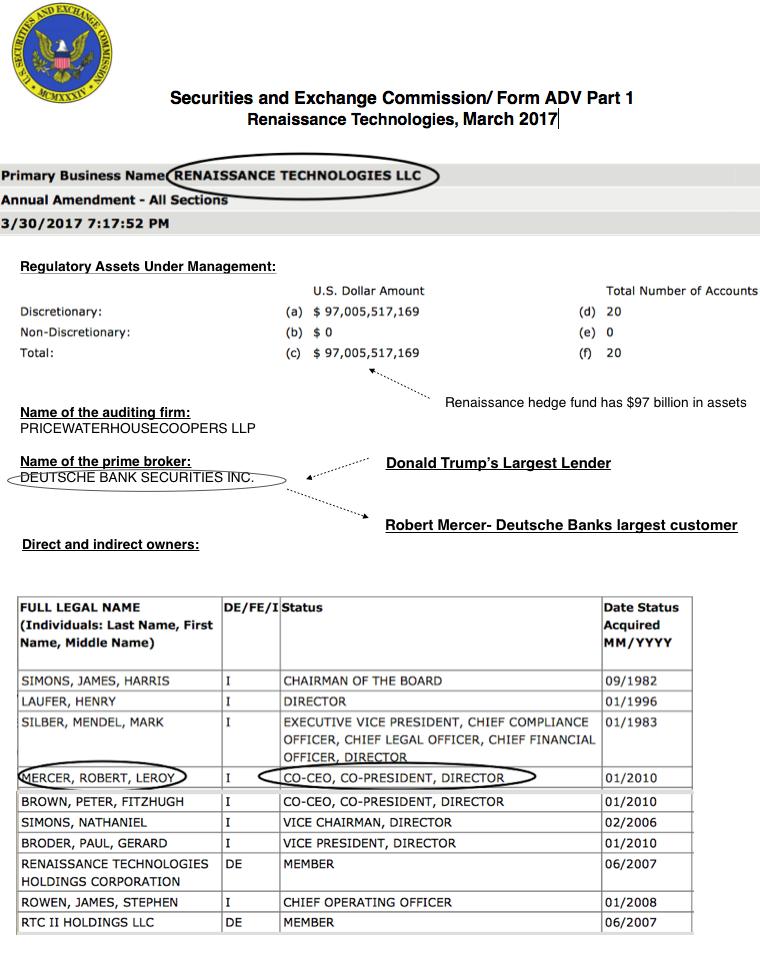

Exhibit 1: Renaissance Technology SEC Filing Noting Robert Mercer is CEO and Deutsche Bank is its Prime Broker, which it uses for millions of security transactions each year.

I’ve reviewed many politicians financial statements and tax returns, both national and local, for a variety of organization including the Wall Street Journal, NY Times, LA Times, Bloomberg and Oregonian. This has included explaining to the WSJ how Romney put $100 million in his IRA, how Jeb Bush constructed his pension plan, how the Clinton’s manipulated their finances and that Bernie Sanders was a big investor in one of AIG’s largest subsidiaries, VALIC.

Did Trump Run for Presidency As A Business Opportunity to Stave off Bankruptcy?

Trump was different in that it was clear to me he ran for President as a business opportunity in a desperate attempt to stave off bankruptcy, one that could have occurred within 2 years. How brilliant is that? Now he has a perfect credit rating and can fill his high risk properties with new top dollar customer activity at will.

Trump’s empire was teetering in 2003. Then the Apprentice reality show started airing in January of 2004 and was a blockbuster success. This brought him cash flow and time. This is likely why his 2005 tax return was “leaked,” given this was about as good as it got for Trump’s income. He still, however paid almost $150,000 in penalties and fees for underpaying his estimated taxes by $22 million.

Given the supposed size of Trump’s investment portfolio, it is also surprising he reported has only $314K in dividends and $9.4 million in interest income, at a time when interest rates were much higher.

Exhibit 2: Donald Trump 2005 Federal Income Tax Return.

Two Things Certain: Trump Does Not Partner Well and He Failed to Learn a Key Lesson from His Father

The purpose of this post is to lay out the key financial pieces in Trump’s financial picture so that you can make your own decision. Two things are for certain. The first is that Trump does not partner well, making the achievement of big goals difficult. Banks and other big real estate players simply don’t trust him.

He is also heavily invested in a declining industry, golf, and has consistently misrepresented his financial picture, not only to the media yet also Securities and Exchange Commission. See SEC action summary at end of post requiring him to restate earnings after inflating net income by 450 percent. Trump reported 63 cents per share when it was actually 14 cents per share. His publicly traded firm then when bankrupt a few years later.

The second lesson that Donald never learned from his father is the power of partnering with the government. Indeed it was government financing programs that helped Fred Trump amass a portfolio of 27,000 housing units. Fred was a hard working carpenter who brilliantly leveraged growth off this key government program.

Fred and Donald Trump

Put another way, if you look at the largest players in real estate today, ranging from the Blackstone Group to LoneStar, one sees that they all partner with tax exempt investment funds, now the largest pools of investment funds.

These tax exempt funds include foundations, endowments and public pensions. CalPERS alone is more than $300 billion. Here in tiny Oregon the public pension system alone has $90 billion invested, including more than $1 billion of Oregon PERS funds with Lonestar.

Largest Investment Pools are Now Tax Exempts. A Key Opportunity Missed by Trump

Calpers alone has more than $300 billion in assets. Also note that eight of the 10 largest pension plans in the U.S. are now tax exempt public pensions. This is a big untold story, how hundreds of billions of dollars of corporate ownership, previously tax paying, has been transferred into tax exempt status via public pensions investments with private equity firms. This makes it hard for tax paying companies to compete and explains why private equity firms intently focus on buyouts and eliminate taxes, often resulting in abusive monopolies in niche sectors of the economy.

Calpers alone has more than $300 billion in assets. Also note that eight of the 10 largest pension plans in the U.S. are now tax exempt public pensions. This is a big untold story, how hundreds of billions of dollars of corporate ownership, previously tax paying, has been transferred into tax exempt status via public pensions investments with private equity firms. This makes it hard for tax paying companies to compete and explains why private equity firms intently focus on buyouts and eliminate taxes, often resulting in abusive monopolies in niche sectors of the economy.

A good example of three firms utilizing these private equity partnerships in the real estate space, directly competing with Trump, are Leon Black of Apollo, Steve Schwartzman of Blackstone and John Grayken of Lonestar. All three have received significant funding from the Oregon public pension system and other tax exempts.

What Blackstone, Apollo and Lonestar also learned, and Trump missed, is that they can gain massive leverage on their returns by enlisting these tax exempt limited partners. These tax exempts now often compose up to 90 percent of all investment dollars in their funds.

This allows the private equity firms to earn massive carried interest fees off these real estate investments. Essentially, leverage on equity rather than debt.

And as Pricewaterhouse Coopers has also noted, more than 70 perent of these carried interest fees are paid in the form of stock options, options that in themselves generate massive tax deductions for taxable general partners like Schwartzman when they are issued from their portfolio companies taken public. Of course these options are also a paper creation for which the tax deductions created never required a cash outlay.

In Trump’s defense, at least his net operating losses generated resulted mostly from real expendidures while those of the private equity firms are a paper creation from stock options they issue themselves for the purpose of enriching themselves and creating a vast pool of tax deductions that can essentially finance subsequent takeovers. Trump was never able to play the stock option game with his companies.

Trump Has Leveraged Using “Debt” While Smarter Competitors are Leveraging Using Tax Exempt Limited Partner “Equity” in Concert With Stock Option Based Carried Interest. All Eyes Now on the “Fractions Rule”

Trump could only get leverage by borrowing from banks, mostly refinancing agreements his father already had in place. Perhaps he “loves debt” because equity partners simply won’t have him.

Further complicating this scenario for Trump is that 90 percent of the profits earned in Blackstone and Lonestar’s partnerships are tax exempt since 90 percent of profits are allocated to their tax exempt partners. This makes it easier for Blackstone and others to bid higher prices for key deals due to a structural lower cost of doing business.

Top on these private equity firms Trump wish list is to be able to allocate “carried interest” to themselves without conforming to the “fractions rule.” See blog post explaining this arcane yet remarkable reform Reagan put in place.

The purpose of the fractions rule is to prevent tax exempt investors from using deductions allocated to them that are unusable by nature since they are tax exempt.

Think about it, if the tax exempts are allocated 90 percent of tax deductions, which are unusable now, and they can instead trade these unusable benefits for other benefits with the taxable general partners such as Blackstone, the tax exempts become tax deduction money trees. Blackstone is already doing this. Meanwhile Trump is foolishly leveraging up with bank debt.

This is how real estate investors were able to invest $1 to get $8 dollars of tax deductions in the 1980’s and why Reagan was incensed and closed the loophole with the “fractions rule.” Hear prominent real estate attorney Sanford Presant boast about this in an ABA presentation in this post here.

Trump simply can’t compete with private equity in the commercial real estate space, only on the very high end by paying too much for properties that are not attractive to others. He has also focused upon golf, a declining sport, and not a good long term risk to the more sophisticated real estate investors. See detailed analysis of Trump businesses later in post.

It was Fred Trump, his self made father, that qualified for big big loans that were passed to Donald upon Fred’s death in 1999. It is interesting that journalists debate over how much Trump inherited from his father, not realizing that the greatest inheritance sometimes is indeed debt. Fred’s death was not a “default event” and therefore the partnerships live on and Donald didn’t have to re-qualify for loans he would never have been approved for.

This debate is particularly important because Trump as President seems to be simply implementing a donor checklist for large private equity investors like Blackstone’s Schwarzman, Carl Icahn and others.

Biggest Financial Winners in a Trump Presidency: Robert Mercer and Deutsche Bank

Robert Mercer and Deutsche bank are indeed positioned for an immediate $20 billion payday resulting from a Trump Presidency. Mercer’s firm is now subject to an iron clad flagrant tax evasion case in which it owes the IRS $7 billion while Deutsche Bank is negotiating with the justice department fines for mortgage and securities fraud that exceed $15 billion.

Robert Mercer is a brilliant speculator who, like his partner Jim Simons, has never made a product or service, yet together they have built a hedge fund, Renaissance Technologies, worth $97 billion per recent SEC filings. Renaissance simply speculates on stocks and commodities and does millions of transactions with Deutsche Bank each year.

One key question given Renaissance does millions of financial speculations each year is how much of this speculative activity is in the energy markets given Deutsche banks links to large Russian banks and energy being the driving force of Russia’s economy? Energy is indeed the largest speculative market with billions made and lost daily.

Rex Tillerson’s Choice as Secretary of State: A brilliant choice for the U.S or Russia?

Although Rex Tillerson is indeed a distinguished business executive having been CEO of Exxon Mobil, Trump choosing him as Secretary of State was odd indeed. Especially with so many brilliant candidates, his close ties to Russia and the related controversy over Russia intruding in our 2016 election.

Would it not be interesting if Russia lobbied to install Tillerson as Secretary of State? Perhaps Trump is simply a Political Puppet subject to a witch hunt and the real focus should be how Russia perhaps constructed his cabinet and thereby influences energy policy.

That is exactly what I would do if I were Putin. Of course I am not Putin. At times it seems as though Putin is far smarter and able to achieve his strategic goals than the sum of Trump and his entire cabinet.

Why the Election Hacking Matters: A Wake Up Call to Mueller

Here in the U.S. we seem absolutely ignorant to the sheer brilliance of Russian computer scientists. Hacking into our election systems is likely “child’s play.” I could even imagine bored Russian teenagers working from video game centers and betting who could best manipulate elections. A potential scenario being, one saying to the other, how about I take the Idaho Senate race and you take a Florida mayoral race.

Perhaps most amazing about the election hacks is the permanence of the information. By knowing key voter identification data and preferences, future elections can be manipulated at will since most now receive news on-line. The Trump administration and specifically Secretary Tillerson have been silent on this reality.

Last week Google did announce that it would stop reading emails for use in targeting ads, due to privacy concerns. And so while all the talk is about Russia’s meddling in the election, why aren’t we also concerned about Google and Facebook doing the same? Perhaps this is a needed wake up call.

Renaissance Tax Evasion Scheme Funded both Trump and Clinton

Renaissance tax evasion scheme with Deutsche bank is so brazen that it resulted in special hearings of the Senate Special Investigations Subcommittee. Meanwhile, Jim Simons became one of Clinton’s largest donors and his partner Robert Mercer one of Trump’s. See link to LA Times article below:

LA Times: They teamed up to conquer Wall Street. Now one is bankrolling Clinton and the other Trump

A key player in Renaissance tax scheme is of course Deutsche Bank, whose largest customer is Renaissance. See SEC filing earlier in post identifying Deutsche Bank as Renaissance prime broker.

Frankly, it seems particularly foolish for Mercer and his daughter to entwine themselves so tightly with a candidate like Trump because with all the hysteria over Russia. They will clearly have their Renaissance transactions, given it is Deutsche Bank’s largest customer, swept up in the inquiry by Robert Mueller, special counsel investigating Russia’s involvement in the 2016 election. This will likely further amplify the scrutiny regarding this massive tax evasion scheme.

Germany and Deutsche Bank’s Relationship with Russia

It’s no secret that Germany has been Russia’s largest import trading partner over the last decade. Deutsche Bank has also been prominent in Russia and a major partner with the largest Russian Banks. Like Trump, the bank is also financially stressed from a variety of factors ranging from its involvement financing the Sochi Olympics to general Euro based debt issues in Italy, Greece, Spain and Portugal. Here is a chart of Deutsche Bank’s stock over the last 10 years. While most banks have recovered nicely since the crisis, Deutsche Bank is still down more than 85 percent from its peak.

Exhibit 3: US Bank (Left) and Deutsche Bank (Right)- Performance 2007-2017.

Russia and Germany Both Have a Growing Presence in the US Economy:

Here in Oregon, Russian and German companies have a large footprint. One of the State’s largest companies, Oregon Steel, was purchased by Roman Abramovich, a Russian oligarch who also owns the Chelsea soccer club. Soon after the purchase most production was outsourced to China and literally nothing has been discussed in the financial press since after the takeover.

More recently, Mentor Graphics, a publicly traded marquee technology company beautifully positioned in a profitable software niche, was purchased by Siemens, Germany’s largest conglomerate. What made this possible was Carl Icahn, who attempted a hostile takeover and forced Mentor to make short term decisions that made it vulnerable to a takeover.

A valuable lesson for Trump might be to focus more on defending existing companies from speculators like Icahn, which invariably cost high quality jobs and move headquarters abroad.

Perhaps Trump is right in that their is a lot of hysteria regarding Russia because when you pull back the curtain, indeed Russians play a key role in our economy. Particularly in the software sector, powering many major websites.

Did Trump Run as a Business Opportunity to Avoid Bankruptcy?

When I first reviewed President Trump’s financials for Bloomberg when he declared he would run for President, his motive seemed clear to me. He’s running as a business opportunity to avoid bankruptcy, I stated. Make up your own mind, based upon hard facts, many of which will be presented in this analysis.

Remarkably, no one has truly outlined Trump’s business empire clearly. So let’s start here. Rather than look at hundreds of LLC’s, many of which are shell organizations, let’s focus on operating businesses and use a key government document as our source, his annual 5500 report with the department of labor.

This is key because any employee participating in the plan at any of the Trump companies will have its organization listed here.

This 5500 report summarizes all organizations for which at least one employee is participating in the Trump retirement plan. Of course any meaningful job will have a retirement option, at least a minimal one. Attracting and retaining employees is too dificult without a plan, even if it is not used by the employees. Even employees from the Trump Carousel subsidiary participate in the plan.

So here it is, a complete list of the operating businesses in the Trump empire. The first visual is from the actual filing and the second lists the same organizations, grouped by activity. Note that more than 50 percent are golf courses, a declining industry.

Exhibit 4: Source 2016 5500 report

Trump Entities Grouped by Activity. Note that if you exclude the “other,” which are small and the admin, more than 50 percent are golf related. Golf is a tough business, even for accessories. Phil Knight recently noted in an interview that Nike, even with Tiger Woods, failed to make golf profitable. We lost money every year for 20 years he noted:

Exhibit 5: Trump’s Financial Disclosure released in June 2017.

Note that he earns an annual pension from the Screen Actors Guild Fund, a $3.5 billion investment fund with 56,000 participants. The average annual pension benefit is $20,000.

Exhibit 6: Comparing the Trump Retirement Plan to Les Schwab, A Tire Dealer.

Here is a brief comparision of Trump’s retirement plan to a large low tech tire distributor based in Oregon, Les Schwab. Note that Trump only contributes on average $725 per year to each participant while Schwab contributes $5,000. Source: Annual 5500 filing with DOL.

Known for his conservative politics, my guess is that Schwab rarely voted for a Democrat. What he was known for was his dedication to his employees and customers, traditional Republican values. Values on display in his pension plan.

Exhibit 7: Renaissance Technology Fee Structure. Are Its Medallion Funds Another Tax Evasion Scheme?

Renaissance manages funds for large institutional tax exempt investors like the Missouri public pension system yet its big profits come from managing its own partners accounts via the “Medallion” group of funds. Indeed the Medallion funds are closed to outside investors and are 99 percent owned by Mercer, Simons and other employees of Renaissance and their respective foundations. For example, Mercer has 100 percent of his foundation invested in Medallion funds and the Renaissance employee retirement plan has 97 percent of its assets in the Medallion funds. Tables to follow, end of post.

Question: Why would Renaissance charge itself a management fee of 5 percent and take an additional carried interest fee of 44 percent, almost 50 percent in total, and charge outside investors no more than 12 percent in total, roughly one fourth of what they charge themselves?

The answer may indeed be another beautifully engineered tax evasion scheme. This practice basically allows them to do millions of short term speculations within the tax exempt shells of its employee pension plan and related tax exempt foundations that produce tax free gains.

Renaissance can then extract large distributions from the employee pension plan, etc. as investment fees characterized as carried interest, which has a tax rate less than half the rate they would pay. Put another way, it pays to over pay fees to themselves. Many investors don’t realize that investment fees charged to retirement accounts are not a taxable distribution.

Given that the Medallion funds are 99 percent owned by employees and their foundations, they are clearly doing these transactions with themselves and breaking all the rules. It is almost difficult to not admire how creative these financial engineers are, while they brazenly break all the same rules we must conform to.

Exhibit 8: Deutsche Bank Website and Other Visuals Noting Trading Ties to Russia.

Exhibit 9: Robert Mercer and Jim Simmons Foundation 990 Filings.

Exhibit 10: Renaissance Technology Retirement Plan Summary of Assets.

Note that 97 percent of assets are invested in the Medallion funds. This is generally not allowed yet Renaissance made a special appeal to the IRS to avoid having to comply with standard fiduciary rules designed to protect employees, noting they were all sophisticated investors not needing such protections.

Also note that no where does Renaissance disclose the exact holdings in Medallion for this reporting period, even though they are invested in their “own deals.” This is clearly not in compliance with the rules to have tax exempt status.

It was indeed Renaissance CEO Robert Mercer who funded a media campaign to remove the current IRS commissioner over targeting conservative tax exempts to determine if they complied with the disclosure rules. Probably not a battle the IRS would now choose, that is to require them to meet the disclosure rules.

Exhibit 11: US Senate Investigation of Renaissance and Deutsche Bank Tax Evasion Scheme. Note that “RenTec” is Mercer’s Renaissance Technologies

Exhibit 12: Top Global Asset Manager, Note Deutsche Bank is #9.

Exhibit 13: SEC Cease and Desist Order Against Trump Hotels for False and Misleading Statements.

Exhibit 13: Trump’s 2016 Financial Disclosure.

Trump appears to be very sloppy indeed with details. His “Presidential Financial Disclosure” filing with respect to assets skipped the following numbers. For example, there is no 3. It is almost as if these were removed, the question is why.

003, 006, 009, 015, 016, 019, 022, 023, 025, 027, 028, 029, 033, 035, 053, 054, 056, 058, 060, 062, 063, 077, 084, 085, 086, 088, 089, 096, 102, 105, 107, 114, 115, 117, 118, 128, 129, 138, 161, 162, 163, 164, 165, 166, 167, 168, 170, 171, 175, 177, 179, 180, 185, 186